Southeast Energy Exchange—New Trading Platform

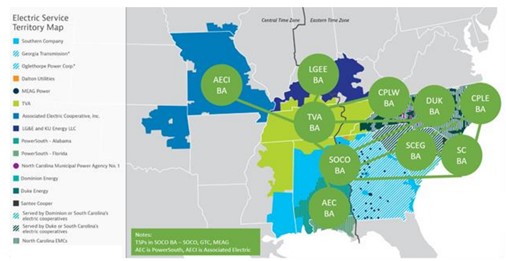

Digitization, AI-powered innovation, cloud technology, and growing renewables is about to transform bilateral trading in the Southeast region. Utilities serving loads in the Southeast region recently joined forces to request the Federal Energy Regulatory Commission (FERC) to operate the “Southeast Energy Exchange Market” (SEEM), an electricity exchange platform that will trade non-firm electricity every 15 minutes. [1] The scope of the market will cover the 10 balancing authority areas (BAAs) of SEEM’s founding entities, which collectively have 160 GW of generating capacity. The SEEM founding entities include Associated Electric Cooperative, Inc. (AECI); Dalton Utilities (Dalton); Dominion Energy South Carolina, Inc. (Dominion Energy SC); Duke Energy Carolinas, LLC (DEC) and Duke Energy Progress, LLC (DEP); Louisville Gas & Electric Company (LG&E) and Kentucky Utilities Company (KU); North Carolina Municipal Power Agency Number 1 (NCMPA Number 1); Power South Energy Cooperative (PowerSouth); North Carolina Electric Membership Corporation (NCEMC); Southern Company (SoCo), and Tennessee Valley Authority (TVA). This member list is expected to expand after Georgia System Operations Corporation (GSOC), Georgia Transmission Corporation (GTC), Municipal Electric Authority of Georgia (MEAG Power), Oglethorpe Power Corporation (Oglethorpe), and South Carolina Public Service Authority (Santee Cooper) receive the necessary approvals from their regulators to join SEEM.

Source: [1]

| Exchange is an organized trading platform that all qualified participants can participate in buying and selling power. They are anonymous but have a transparent wholesale price formation mechanism. |

Key Features of SEEM

The market design of SEEM is to serve non-firm bilateral trading, particularly intermittent resources, as SEEM will match bids and offers every 15 minutes. Market prices are determined based on a 50-50 split of the savings to each buyer and seller pair. Thus, there is no single market clearing price within a market interval, unlike a typical power pool. This exchange platform will match buyers’ bids with sellers’ offers, taking available transmission capacity of contract paths within its geographic market (i.e., its members’ transmission networks) into consideration along with constraints of buyers and sellers. The latter could consist of points of delivery, points of injection, credit ratings or their financial restrictions.

The available transmission service for SEEM is a new service called Non-firm Energy Exchange Transmission Service (NFEETS). There is no reservation as the available transmission capacity data would be pulled from the “Network Map” [3] provided by all participating transmission providers on an as-available basis in 15-minute market intervals. It therefore has the lowest priority of all available services.

To avoid any inefficiency from transmission rate pancaking, SEEM transactions will not bear any wheeling charges. Members and market participants will pay for SEEM’s administrative costs as follows: 25% will be equally distributed while the remaining 75% will be allocated proportionally based on each participant’s net energy load transacted via SEEM. In addition, there are no fees for scheduling and dispatching (Schedule 1 of OATT) and reactive power (Schedule 2). Losses are financial and will be incurred by buyers based on their matching transaction pairs.

Some restrictions are:

- To avoid potential gaming, the platform will not match the same pair of buyer-seller and seller-buyer at the same location in the same market interval.

- SEEM utilities with no market-based rate authority in their own BAAs will not sell power to entities in their BAAs.

- Members can only be load-serving entities and public power agencies.

Group of Clean Energy Buyers’ Opposing Comments

A group of buyers (Buyers) questioned whether the SEEM proposal promotes sustainable wholesale competition for clean energy as the proposal lacks details, which could lead to unfair treatments and significant costs. [4] Among their arguments, they claimed that SEEM is a loose power pool and thereby needs to have a joint pool-wide OATT, instead of using separate transmission providers’ OATT. They also asserted that by limiting the SEEM membership to load serving entities and public power agencies, SEEM’s governance would be partial and inconsistent with the FERC’s regulation (Order 888). They have asked FERC to broaden the SEEM membership to include Independent Power Producers (IPPs) to be represented on SEEM’s Board. This point is important because the board can only consist of its members (not market participants). Otherwise, SEEM will do “little to advance the status quo minimum open access market structure in the Southeast…,” since some of the founding SEEM members have horizontal market power in their local BAAs. [5]

Additionally, Buyers emphasized that under the SEEM proposal an auditor’s role is limited to detect market power and market manipulation, given that it will neither monitor market participants’ behavior nor provide suggestions on how to improve SEEM. It “…will only ensure that SEEM is “operating correctly and in accordance with the Market Rules.” [6]

Our Observations

As renewable resources increase, system operators face the challenge of integrating excess intermittent energy into their grid while maintaining the reliability of their networks. To help them manage this issue and minimize costs, the Southeast utilities formed SEEM so that they can trade shortage and excess energy on a 15-minute basis, which they could not have traded through available existing trading platforms within their region.

The Southeast region currently does not have a centralized wholesale power market; much of their economy energy trading have been done bilaterally on a day-ahead basis. The volumes of intra-trades were low. Any imbalances are done through each BAA’s transmission system operator under OATT. Thus, SEEM is designed to bring together this missing energy product and highly intensive information (constraints of both network and market participants) to the marketplace via a digital platform.

SEEM has characteristics similar to the European energy exchange platforms operated by Nord Pool and EPEX (collectively, “EU Market Coupling Model”). Under the EU model, buyers and sellers can transact energy products through a market run by a market operator. Then, any actual power delivery will be scheduled with each system operator that operates a domestic real-time balancing market. These markets have evolved from having energy and transmission as separate products to a point where they are now combined. NordPool and EPEX, for instance, are market operators that manage day-ahead, and intra-day cross-border hourly energy markets. [7] Although they are independent, they use the same market clearing price algorithm and obtain the same set of transmission data from transmission system operators (with ENTSO-E). Each of day-ahead and intra-day algorithm jointly clears all bids and offers in the European day-ahead energy/intra-day markets, given the network constraints across EU countries. [8] Nevertheless, there can be different prices in different areas due to constrained interconnectors. There is no matching of a bid and offer pair and a “split-saving” price as in SEEM.

Differences in their price formations can exist, given their market objectives. This is typical due to various market designs and implementations observed across the globe or even among ISOs in the U.S. What important is the features of a market/exchange platform that would ensure a workably competitive market outcome. Not only does SEEM require a market operator that is independent, with no affiliations to market participants (like other energy exchanges), but it also needs a market operator who can detect market rules that create barriers to trade and market participants’ anti-competitive behaviors, even if the monitoring would be done on an ex-post basis. After all, uncertainty in a market can be induced and create anti-competitive behavior.

References and Notes

[1]: Southern Company Services, Inc. et.al., Southeast Energy Exchange Market Agreement, Docket No. ER21-1111et.al., February 12, 2021. [2]: Id. at 4. [3]: Network Map means the computer-based representation of all Participating Transmission Provider service territories, Balancing Authorities, valid transmission paths (Point of Receipt – Point of Delivery combinations), Sources, and Sinks. [4]: Comments of Advanced Energy Economy, Advanced Energy Buyers Group, Renewable Energy Buyers Alliance, and The Solar Energy Industry Association, Docket No. ER21-1111et.al., March 15, 2021. [5]: Id. at 17. [6]: Id. at 25. Footnote omitted. [7]: Nord Pool and EPEX started their exchanges by trading block forward products. [8]: Pricing is based on the European Union’s (EU’s) Target Model using the same market clearing price algorithm for day-ahead and intra-day markets. The day-ahead algorithm is called the EU’s Pan-European Hybrid Electricity Market Integration Algorithm (Euphemia). The intra-day algorithm is called the EU’s Cross-Border Intraday (XBID) solution.