CCUS and Clean Energy Transition—New Era

Recently, carbon capture, utilization, and storage (CCUS) technologies have gained more attention. These technologies are not new as they have been used to enhance the production in hard-to-abate industries (such as cement, petrochemicals, iron and steel, fertilizers, and natural gas processing). Many experts now see CCUS as a crucial tool to mitigate the climate change risk, particularly in hard-to-abate industries which emit over 20% of greenhouse gas emission (GHG). To make meaningful progress in the clean energy technology-neutral transition, the Inflation Reduction Act (IRA) provides several incentives, such as direct pay, production tax credits (PTCs) and investment tax credits (ITCs) for new CCUS facilities that are placed in service after 2024. This is applicable for CCUS in electric power plants and manufacturing.

What is CCUS?

CCUS is a process of capturing CO2 during an industrial production process, and storing it for later use. The two main methods for capturing CO2 occur in the post- and pre- combustion processes. In the post-combustion process CO2 is separated from flue gases by using a variety of technologies. For instance, amine-based absorption can be used to extract CO2. For low carbon, the application of membrane gas separation can be used for capturing CO2. One pre-combustion process for CO2 capture converts fuel into a gaseous mixture of mostly hydrogen and CO2. This application, as an example, occurs in a hydrogen production process that uses fossil fuels. Another pre-combustion process utilizes steam methane reforming (SMR), in which natural gas reacts with steam at an elevated temperature to produce carbon monoxide and hydrogen. This subsequently creates the water-gas shift reaction that converts the carbon monoxide to additional hydrogen and CO2.[1] The CO2 then can be captured and injected to store underground. A geologically secure and safe storage option requires certain types of porous rock formations to allow CO2 to flow. These porous rock formations must be deep underground (e.g., 800 meters or more) with thick, large continuous areas.

CCUS is not new, as some industrial sectors have captured and sold CO2 to the oil industry for enhancing its oil recovery, particularly in the older or depleted oil wells.[2] In the U.S., CCUS has been used since 1970s. The Terrell Natural Gas Processing Plant for example, has captured CO2 as part of its gas processing, and transported it via pipeline for enhanced oil recovery. Similarly, the Koch Fertilizer production facility in Enid, Oklahoma, also transports its CO2 that is generated from its nitrogen fertilizers to depleted oil fields. In Taiwan and Japan, to increase efficiency in the cement mixing process, calcium oxide (CaO) is used to capture CO2 in the flue gas (known as the calcium-looping process).[3]

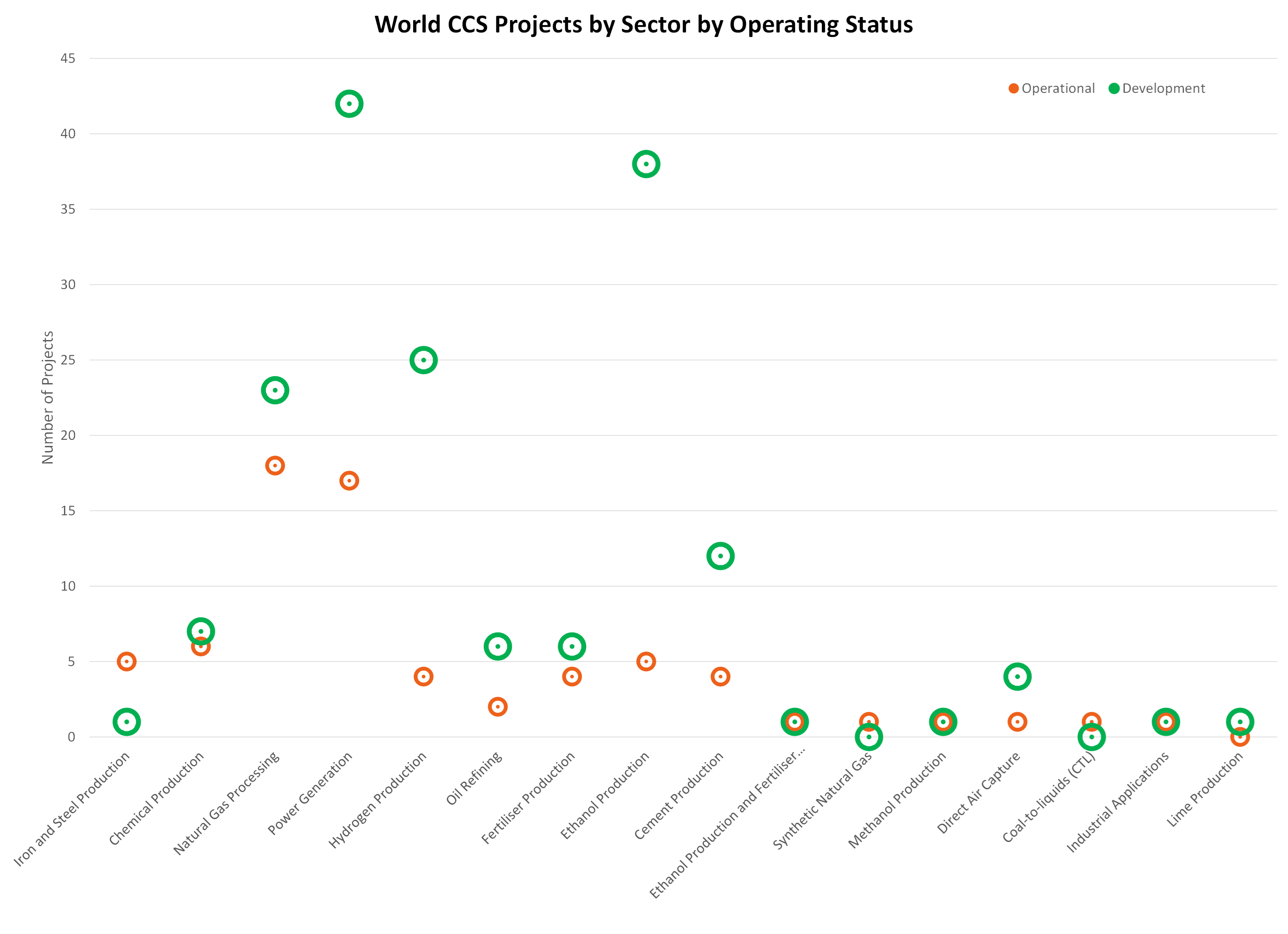

There are currently 77 CCUS facilities operating around the world. This number is expected to quadruple by 2030. As shown in Figure 1, this increase will result from projects in the natural gas processing, power generation, hydro generation, fertilizer production, and ethanol sectors. Large oil companies are working to establish CCUS hubs nearby hard-to-abate industrial customers. For instance, ExxonMobil plans to store emissions in the nearby Houston industrial area. If all of these proceed as planned, it will strengthen the Paris Agreement’s net-zero emissions commitment.

Figure 1

Source and Note: RPB Energy Economics LLC. Data from Global CCS Institute.

Source and Note: RPB Energy Economics LLC. Data from Global CCS Institute.

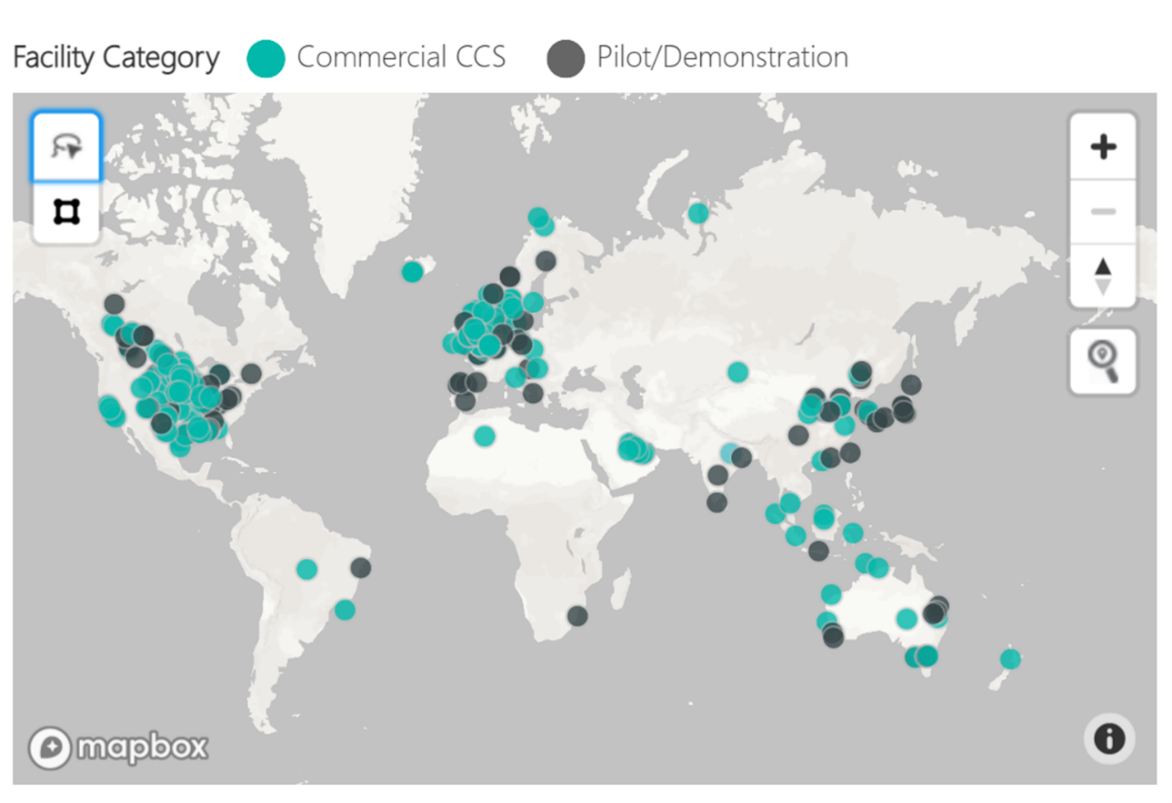

As shown in Figure 2, most of the CCUS projects either are, or are planned to be, located in the U.S. and EU.

Figure 2

Existing and Planned CCS Projects

Source: Global CCS Institute. Downloaded on March 21, 2023.

Source: Global CCS Institute. Downloaded on March 21, 2023.

In the UK, as part of its Ten Point Plan for a Green Industrial Revolution the British government has started CCUS demonstration projects aiming to capture 10 MtCO₂ per year by 2030. Although the projects are still in an early stage of development, the projects are designed as CCUS clusters by siting different sectors in a close proximity in order to share a carbon dioxide transport and storage. Its recent selected cluster, for instance, includes a dispatchable low carbon power generation, industrial process emissions (cement, lime, and energy from waste) and low carbon hydrogen production. The facilities will connect to a carbon dioxide pipeline and storage infrastructure.[4]

Cost Barriers

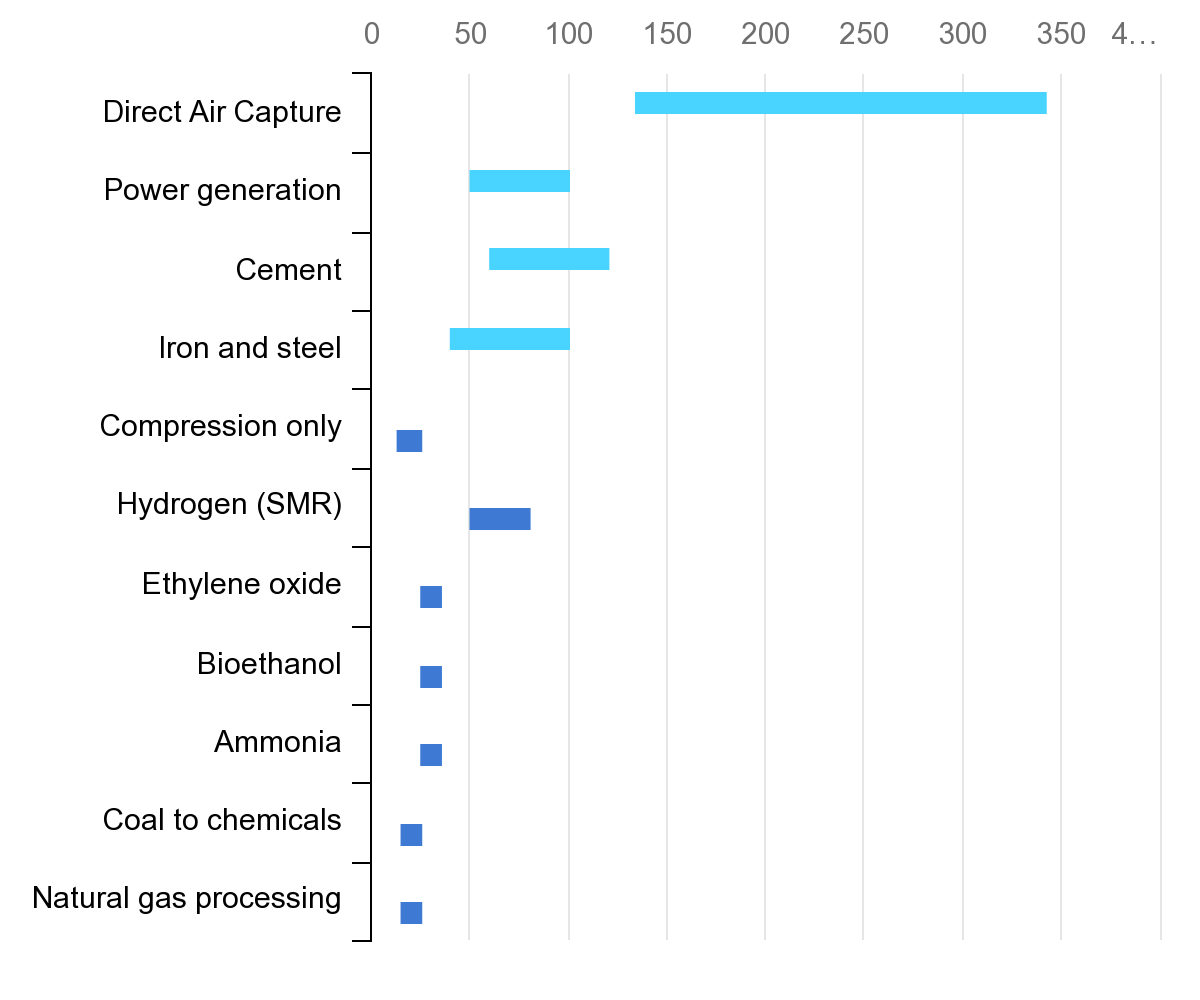

CCUS is an expensive process. According to the IEA, the levelized costs of CCUS projects ranged from less than $50 per tonne of carbon captured to almost $350/tonne. The cost per tonne depends upon the concentration of CO2, the capture technology used, plant size, process design, plant utilization, and transportation to storage areas.

As shown in Figure 3, the natural gas processing sector has the lowest cost of CCUS applications, which is well below $50/tonne. The highest cost application is from a direct air capture application. Its cost ranges from $140/tonne to almost $350/tonne. The levelized cost of the power generation electricity sector is also relatively high ranging from $50/tonne to $100/tonne. This same cost range applies to the iron and steel, and cement industries.

Figure 3

Levelized Costs of CCUS Application By Sector ($US/tonne)

Source and Note: IEA, 2020. The dark blue bar represents low CO2 concentration. The light blue bar represents high CO2 concentration. The graph can be downloaded at Levelized cost of CO2 capture by sector and initial CO2 concentration, 2019 – Charts – Data & Statistics – IEA

Source and Note: IEA, 2020. The dark blue bar represents low CO2 concentration. The light blue bar represents high CO2 concentration. The graph can be downloaded at Levelized cost of CO2 capture by sector and initial CO2 concentration, 2019 – Charts – Data & Statistics – IEA

The IEA analysis based on own estimates and GCCSI (2017), Global costs of carbon capture and storage, 2017 update, IEAGHG (2014), CO2 capture at coal based power and hydrogen plants, Keith et al. (2018), A Process for Capturing CO2 from the Atmosphere, NETL (2014), Cost of capturing CO2 from Industrial sources, Rubin, E. S., Davison, J. E. and Herzog, H. J (2015), The cost of CO2 capture and storage. CO2 capture costs for hydrogen refers to production via SMR of natural gas; the broad cost range reflects varying levels of CO2 concentration: the lower end of the cost range applies to CO2 capture from the concentrated “process” stream, while the higher end applies to CO2 capture from the more diluted stream coming out of the SMR furnace. Cost estimates are based on the United States. All capture costs include the cost of compression.

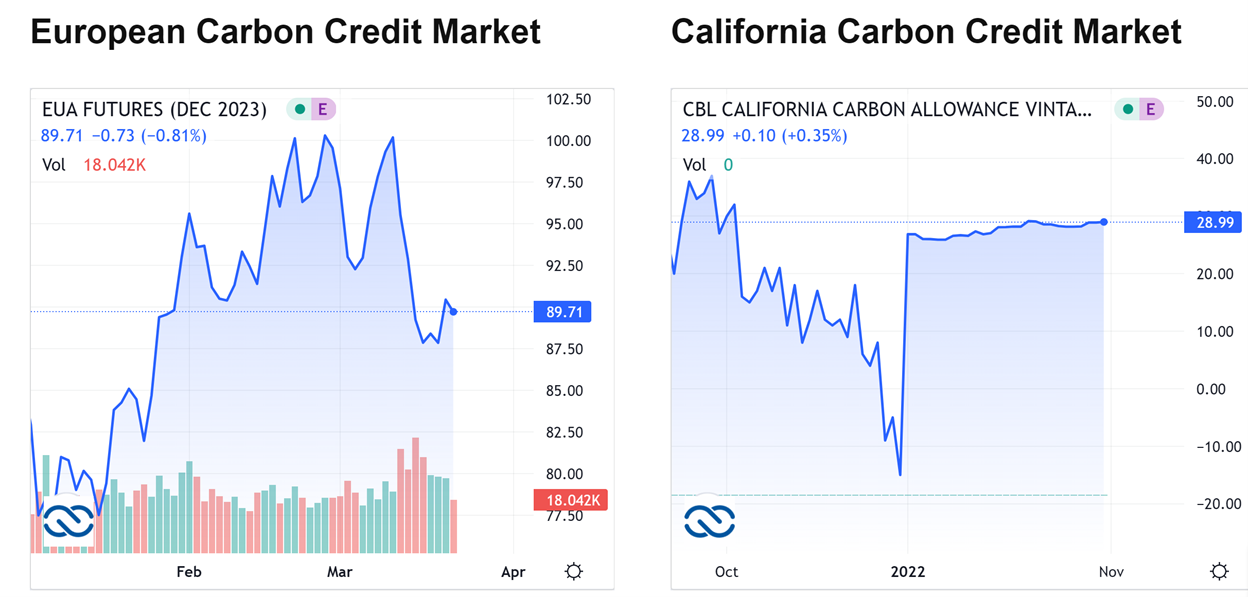

These costs are far above the carbon credit prices in the California carbon credit market, which is currently around $28.99/tonne. It is therefore difficult to incentivize CCUS investment in the U.S. This is opposite to the carbon credit prices in the European Union (EU), which rose above €100/tonne in February and March 2023.

Figure 4

Source and Note: The right hand axis of each graph represents carbon credit prices. The price per unit for the European and California carbon credit markets are €/tonne and $/tonne, respectively. The graphs were taken from Carbon Credits on March 23, 2023 at https://carboncredits.com/carbon-prices-today/

Source and Note: The right hand axis of each graph represents carbon credit prices. The price per unit for the European and California carbon credit markets are €/tonne and $/tonne, respectively. The graphs were taken from Carbon Credits on March 23, 2023 at https://carboncredits.com/carbon-prices-today/

IRA’s CCUS Tax Credits

To provide incentives for new CCUS facilities, the IRA provides tax credits for CCUS facilities through the technology-neutral PTC (45Y), the advanced energy project credit (ITC 48C) and the 45Q provision.

The technology-neutral PTC creates a PTC credit of 1.5 cents/kWh of electricity produced and sold or stored at facilities with zero or negative greenhouse gas (GHG) emissions that will be placed into service after 2024. The facilities can claim a credit at 100% value in the first year and phase out completely in the later of 2032, or when emission targets are achieved.

The IRA replaced the existing technology specific ITC with the technology-neutral clean electricity ITC (§ 48), starting in 2025. This provision creates an ITC credit of 30% in the year that the facility is placed in service. The electricity generating facilities will receive additional credits, ranging from 10% to 20%. For instance, electricity projects will receive a 10% bonus if they meet domestic manufacturing requirements for steel, iron, or other manufactured components, or if they are located in a brownfield, fossil fuel communities, low-income communities, or on Tribal land. In addition, the IRA’s § 48C provides credits to advanced energy projects, including those sited at manufacturing facilities that want to reduce their greenhouse gas emissions by at least 20%. The qualified advanced projects are low-carbon industrial heat, carbon capture, transport, utilization and storage systems, and equipment for recycling, waste reduction, and energy efficiency.

The 45Q provision extends the deadline for construction and retrofitting CCUS facilities to January 1, 2033 and increases the tax credit of CCUS and direct air capture technologies:

- From $50 to $85 per ton for industrial facilities and power plants for saline geologic formations;

- From $35 to $60 per ton for utilization of captured CO2 in enhanced oil recovery;

- From $50 to $180 per ton for DAC stored in saline geologic formations and from $35 to $130 per ton for utilization in enhanced oil recovery.[5]

But the CCUS projects for electricity generating units are required to capture at least 75% of unit CO2 production. The projects will receive direct pay for the first 5 years after the carbon capture equipment is placed in service. Nonprofit organizations and co-ops can receive direct pay for all 12 years of the credit.

References and Endnotes:

[1] Hydrogen can be produced by using renewables to generate electrolysis, but this is generally more expensive than the SMR method.

[2] The method primary injects CO2 into dwindling older oil wells to force more crude oil out of the ground.

[3] Calcium-Looping CO2 Capture Technology, Industrial Technology Research Institute, https://www.itri.org.tw/english/Calcium-Looping-CO2-Capture-Technology?CRWP=621024013054352667

[4] https://www.ccsassociation.org/all-news/ccsa-news/government-sets-out-next-steps-for-ccus-clusters/

[5] 1 ton is a measuring unit widely used in the U.S. 1 ton equals to 0.90718 tonne (or metric ton).